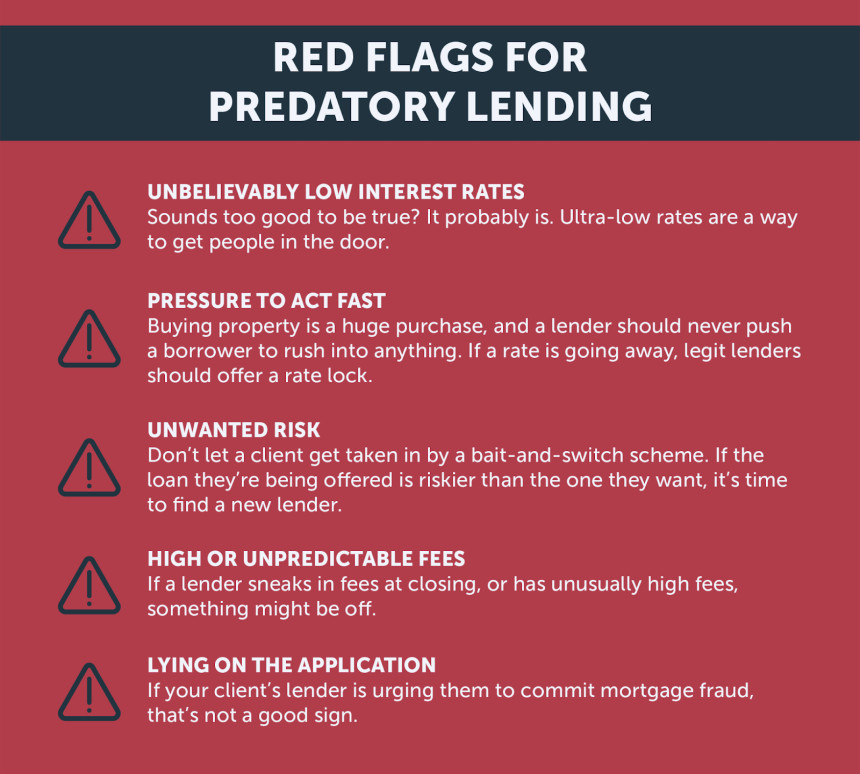

How to Spot Predatory Lending Practices

Spotting predatory lending practices is crucial to protect yourself from potentially harmful and exploitative financial arrangements. Here are some warning signs to be aware of:

1. High-Pressure Sales Tactics:

- Predatory lenders may use aggressive tactics to pressure you into making a quick decision. They may rush you through the process without giving you time to review and understand the terms.

2. Unrealistic Promises:

- Be wary of lenders who make promises that sound too good to be true. If an offer seems too favorable or claims guaranteed approval without proper evaluation, it could be a red flag.

3. Excessive Fees and Charges:

- Predatory lenders may impose excessive fees, such as high origination fees, application fees, or prepayment penalties. These can significantly increase the cost of the loan.

4. Misleading or Incomplete Information:

- Watch out for lenders who withhold or provide unclear information about the terms and conditions of the loan. They may downplay risks or avoid answering your questions directly.

5. Variable Interest Rates with No Cap:

- If a lender offers a loan with a variable interest rate but doesn't specify a cap on how high the rate can go, it could lead to unmanageable payments in the future.

6. Asset-Based Lending:

- Be cautious if a lender focuses primarily on the value of your collateral rather than your ability to repay the loan. Predatory lenders may push you to borrow more than you can afford.

7. Balloon Payments:

- Predatory loans may include a "balloon payment" – a large, lump-sum payment due at the end of the loan term. This can be financially burdensome for borrowers.

8. Negative Amortization:

- Avoid loans where the monthly payments are so low that they don't cover the interest, leading to an increase in the total loan balance over time.

9. Unregistered or Unlicensed Lenders:

- Always verify that a lender is registered and licensed to operate in your state. Unregistered or unlicensed lenders are more likely to engage in predatory practices.

10. Lack of Transparency:

- Legitimate lenders are transparent about the terms of the loan, including interest rates, fees, and repayment schedules. If details are unclear or evasive, proceed with caution.

11. Refinancing Offers with High Costs:

- Be cautious of lenders who encourage you to refinance your existing loan with promises of lower payments, but fail to disclose the substantial costs involved.

12. Single-Purpose Loans:

- Some predatory lenders may only offer a specific type of loan, such as home improvement or debt consolidation, limiting your options and potentially leading to higher costs.

13. No Credit Check Required:

- While it may seem appealing, a lender not conducting a credit check could be a sign of a predatory practice. They may be more interested in taking advantage of your financial situation.

If you encounter any of these warning signs, it's essential to proceed with caution and consider seeking advice from a trusted financial advisor or a nonprofit credit counseling agency. Additionally, report any suspicious lending practices to your state's regulatory authority. Remember, it's important to fully understand the terms of any loan before committing to it.